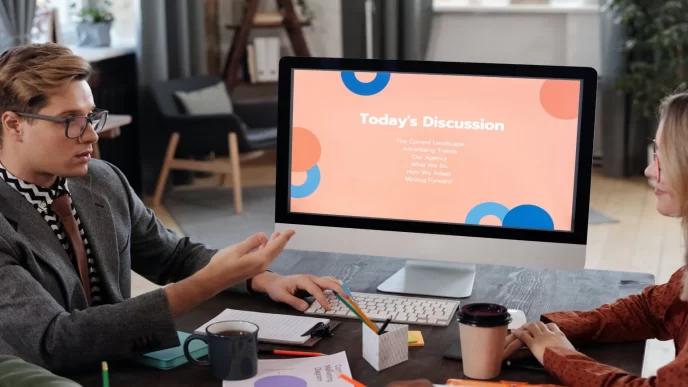

The deep tech investment landscape is experiencing a significant shift. Although scientific innovation is advancing rapidly, securing funding and scaling breakthrough ventures has become increasingly challenging.

For Dr. Ben Miles, founder of London-based Empirical Ventures, the solution lies in closing the gap between brilliant scientists and venture capitalists. With experience in both research and investment, Dr. Miles shares unique insights into overcoming these barriers and unlocking the next wave of deep tech innovation.

In an interview with Entrepreneur UK, he discusses why empowering scientists to become entrepreneurs is key to driving progress in this complex sector—and how initiatives like Spin Up Science are helping make it possible.

Why Scientists and Investors Speak Different Languages

Deep tech startups often struggle to secure funding because scientists and investors fail to connect. As Dr. Miles puts it, “Scientists and investors enter conversations speaking different languages.” Many researchers assume that building a successful business is beyond their expertise—limiting their confidence to pursue commercial opportunities.

However, Dr. Miles believes the scientific mindset is exactly what it takes to launch world-changing ventures. “The same approach scientists use in their research—testing ideas, refining models, and relying on data—is what’s needed to build breakthrough companies,” he explains.

Programs that introduce scientists to peers who’ve successfully made the leap into entrepreneurship are vital. These connections foster collaboration and provide a clear roadmap, turning cutting-edge discoveries into impactful businesses.

The Hidden Edge: Why Scientist-Founders Outperform

Unlike traditional entrepreneurs driven by market trends or gut instincts, scientists bring a unique advantage—they operate at the very edge of human knowledge. Dr. Miles explains, “Great entrepreneurs see opportunities others miss. Scientists are trained to do exactly that.”

Their deep understanding allows them to uncover hidden potential others might overlook. More importantly, they rely on evidence—not hype—to validate ideas. “Scientists don’t just believe something works. They understand why it works and how it can scale,” he adds.

This rigorous, analytical approach helps scientist-founders create businesses that stand the test of time—grounded in scientific proof rather than market buzz.

Why Deep Tech Needs Scientist-Led Investors

According to Dr. Miles, deep tech investing demands more than a surface-level understanding of science. Yet, many early-career investors aren’t equipped to evaluate these complex ventures. “Deep tech investing isn’t about being familiar with buzzwords. It’s about building conviction from understanding the science deeply,” he stresses.

He warns against relying on generic investor training or AI-generated reports. “That approach risks confusing complexity with progress.” Instead, investment decisions must be rooted in hands-on scientific knowledge.

Without this expertise, deep tech investments can become speculative—damaging investor trust. “Tourist investors in deep tech risk making bad calls that shake confidence across the sector,” Dr. Miles adds.

The Rise of the ‘Venture Scientist’ — Scientists Becoming Founders

One of the most promising trends reshaping deep tech is the rise of scientists swapping academia for entrepreneurship. More PhDs are now launching startups instead of sticking to research or academic careers—a shift Dr. Miles views as critical for future growth.

“The scientist’s role is evolving—from discovery to execution. We’re witnessing the rise of the Venture Scientist,” he says.

Historically, scientific discoveries were often commercialized by seasoned business leaders—a costly model with limited scalability. But today, more scientists are stepping up to build their own ventures. “Empowering PhDs to become founders is essential—not just for deep tech but for solving society’s biggest challenges,” Dr. Miles explains.

These Venture Scientists combine scientific rigor with strategic execution. They interrogate data, refine models, and execute plans with precision—turning world-class research into scalable companies.

Evidence-Driven Investing: The Secret to Picking Winners

At Empirical Ventures, Dr. Miles and his team follow one guiding principle: invest based on evidence, not industry hype. “We don’t chase trends. We back ventures where the evidence points to scalable impact,” he explains.

Their approach is simple—target technologies that offer proven mechanisms for real-world change. “We’re looking for deep insights that others miss, paired with founders who have the clarity and conviction to pursue them,” he adds.

This commitment to evidence-based investing ensures they back businesses with genuine potential, not just the latest buzzwords or fleeting trends.

Empowering Scientists with Programs Like Spin Up Science

Dr. Miles is a vocal supporter of initiatives like Spin Up Science—programs that equip researchers with the commercial skills needed to turn lab breakthroughs into market-ready products.

“The future belongs to those who transform scientific discovery into real-world impact,” he says. Spin Up Science plays a crucial role by strengthening the bridge between academia and entrepreneurship.

“Scientists trained in business can interrogate data, uncover hidden potential, and scale transformative technologies,” Dr. Miles explains. These programs don’t just teach entrepreneurship—they prove that scientists are uniquely positioned to lead the next wave of deep tech startups.

If the right support structures are in place, groundbreaking scientific intellectual property won’t gather dust in academic journals. Instead, it will fuel new businesses that drive economic growth and solve global challenges.

The Road Ahead: A Deep Tech Future Built by Scientists

The future of deep tech depends on one thing—bridging the divide between science and business. According to Dr. Miles, this means empowering more scientist-founders, cultivating investor expertise, and strengthening the ecosystems that connect research and commerce.

When scientists are given the tools and confidence to lead, they can create world-changing companies that tackle our biggest challenges—from climate change to healthcare.

By focusing on evidence, nurturing talent, and investing in scalable science-driven ventures, deep tech can deliver real impact—and shape the future of our world.