Marshmallow, the U.K. startup revolutionizing insurance for migrants, has raised $90 million at a $2 billion valuation to expand its offerings. The funding, split equally between equity and debt, will support the company’s goal to diversify into financial services while continuing to innovate within the insurance sector.

Founded to serve underserved migrant populations, Marshmallow has already insured over 1 million drivers and achieved a profitable annual revenue run rate of $500 million. CEO Oliver Kent-Braham sees migration as a significant opportunity, noting that 1.2 million migrants arrived in the U.K. in 2024 alone. “Migration is key to putting more people into the workforce, and we want to support migrants with the financial services they need to integrate successfully,” he said.

In addition to its core car insurance business, Marshmallow plans to expand into other areas of financial services, including home insurance and lending products. The startup aims to be a “one-stop shop” for newly arrived migrants, offering everything from vehicle insurance to personal loans. Kent-Braham confirmed that Marshmallow plans to launch its first lending product later this year.

The startup’s recent valuation marks a significant leap from its previous $1.25 billion valuation in 2021, following rapid growth. Marshmallow has now become a prominent name in the insurance sector thanks to its inclusive approach and data-driven innovations. Its distinctive outdoor ad campaign in cities like London has contributed to its visibility and growing customer base.

The $90 million round was led by Portage Capital, with additional participation from BlackRock and Columbia Lake Partners. To date, Marshmallow has raised around $220 million, with previous investors including Passion Capital, Investec, and Scor.

Marshmallow’s success comes at a time when the European insurtech sector is seeing both struggles and signs of sustainable growth. For instance, WeFox, a once high-flying competitor, has faced challenges, with its business model under pressure. However, companies like Marshmallow that leverage technology and AI to build smarter, more efficient insurance models are drawing investor attention.

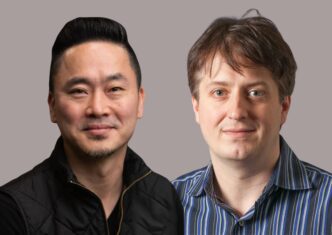

Data science and AI have become essential for insurance startups, and Marshmallow stands out for its inclusive approach, as its leadership reflects the diverse community it aims to serve. Co-founders Oliver and Alexander Kent-Braham launched Marshmallow with a clear focus on the underserved market of migrants. This mission resonates deeply, as Marshmallow is one of only two “unicorn” startups in the U.K. founded by Black entrepreneurs.

Kent-Braham emphasizes that diversity in leadership brings different perspectives, which is key to creating innovative financial solutions. Devon Kirk, GP and co-head of Portage Capital Solutions, praised the founding team, recognizing that a diverse leadership team is a strength in creating solutions that cater to diverse needs.

As Marshmallow looks to the future, its expansion into additional financial services and further innovations in insurance technology will likely continue to shape its growth in the U.K. and beyond.