At a time when most engineers chase big paychecks and flashy industries, a Polish startup is quietly rewriting the rules of insurance—and attracting top talent while doing it. Ominimo, an AI-powered insurtech that’s growing fast, is turning a profit, and now drawing interest from major global players.

Founded just a year ago, Ominimo launched without outside capital. Yet it already manages over 300,000 auto insurance policies in Hungary, its first and only market so far. Now, with big expansion plans ahead, it has secured its first external investment—a strategic move backed by Zurich Insurance Group.

While neither company disclosed the deal size, sources confirm that Zurich has invested €10 million (around $11 million) for a 5% stake, valuing Ominimo at €200 million ($220 million).

Thriving While Competitors Struggle

This milestone comes as Europe’s broader insurtech landscape shows signs of struggle. Once-valued unicorns like WeFox are scaling back or scrambling for fresh funds. In contrast, Ominimo is gaining ground through solid fundamentals and a smart use of AI.

Though it’s profitable, Ominimo’s operation is still focused: for now, it’s only selling car insurance in Hungary. But the vision is much larger. Backed by Zurich, the startup plans to enter over 10 new markets, starting with Poland, Sweden, and the Netherlands. In this next chapter, Ominimo will act as a managing general agent (MGA), offering policies under Zurich’s risk coverage.

A Team of Builders, Not Consultants

The company’s roots go back to its co-founders’ frustration with legacy systems. CEO Dusan Komar, formerly of McKinsey, saw how slow decision-making, outdated software, and uninspired teams stalled innovation in big insurance firms. Alongside co-founders Dennis Weinbender and Laslo Horvath, he set out to build something smarter.

“No brilliant software engineer or data scientist dreams of working for a traditional insurance company,” Komar said. But what if they were given the freedom to innovate?

That question became Ominimo’s mission. Instead of reinventing everything from scratch, the team used modern APIs to plug in essential services, while focusing their core effort on smart pricing. This modular approach allowed them to stay lean and scale fast.

Reinventing Risk with AI

The real secret sauce? AI-powered risk assessment. Traditional insurers might use a handful of data points to determine premiums—like age, income, car type, and driving history. Ominimo digs deeper. It taps into vehicle-specific databases, analyzing over 100 data points, including a car’s dimensions and weight.

Komar highlighted one surprising insight: “Data shows a strong link between a car’s length and how often it gets scratched while parking.” These subtle variables help Ominimo price risk more accurately—and profitably.

Many startups claim to use AI, but Komar insists Ominimo’s market results speak for themselves. In Hungary, it holds a 7% market share and reports a loss ratio below industry average, a key profitability metric.

Brains Behind the Backend

He also believes Ominimo stands out because it actually delivers on the tech promise. While some startups focus only on slick user interfaces, Ominimo puts the intelligence in the backend too.

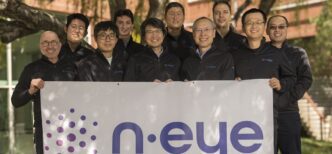

“There’s a big difference between looking data-driven and actually being data-driven,” Komar said. To prove the point, he revealed that eight members of Ominimo’s data team are international medalists in mathematics and physics competitions.

This unique focus on talent and precision has caught Zurich’s eye. The company wants to expand its European retail footprint and sees Ominimo as a gateway to new customers.

Zurich’s Strategic Play

“Growing our retail business profitably is a key ambition in Zurich’s 2025–2027 cycle,” said Alison Martin, CEO for Europe, Middle East, and Africa at Zurich Insurance Group. “Our new partnership with Ominimo will allow us to offer innovative motor insurance solutions and broaden our reach in Europe.”

With Zurich on board, Ominimo is ready to scale beyond Hungary—and beyond car insurance. The team plans to enter property insurance next, bringing its data-first approach to a wider range of policies.

If Ominimo can replicate its success in more countries and categories, it could become a defining force in Europe’s insurtech future—powered not just by AI, but by bold ideas and brilliant minds.